Identify your financial goals and create a roadmap to achieve them.

- Home

- Foundational Planning

Ready to take your

financial future to

the next level?

Start Your Journey. Build Your

Foundation. Plan for Your Future.

With Foundational Planning, you can get clarity, confidence, and a personalized roadmap to reach your biggest financial goals.

When your employer partners with us, you get access to one-on-one guidance from a dedicated Financial Advocate – at no cost to you.

Your Financial Advocate will help you navigate key areas of your financial life, including:

Understand your cash flow and build healthy financial habits.

Evaluate your investment strategies and accounts to help grow your wealth.

Build a financial strategy that gives you peace of mind for the future.

Here’s what to expect:

1. Meet Your Financial Advocate

When you schedule your first appointment, you’ll be matched with a Financial Advocate to talk about where you are now, what matters most to you, and where you want to be financially.

2. Prioritize Your Goals

Whether you're planning for a major life event, working towards achieving a long-term goal, or managing day-to-day finances, your Financial Advocate will help you create a plan that works for you.

3. Implement Your Financial Plan

After your initial call, your Financial Advocate will be your accountability partner for your financial goals. There’s no limit to the number of calls, so you can follow up as often as you need to stay on track.

Our tools and reports help you better understand your finances and make confident decisions.

Below are some of our most frequently requested reports:

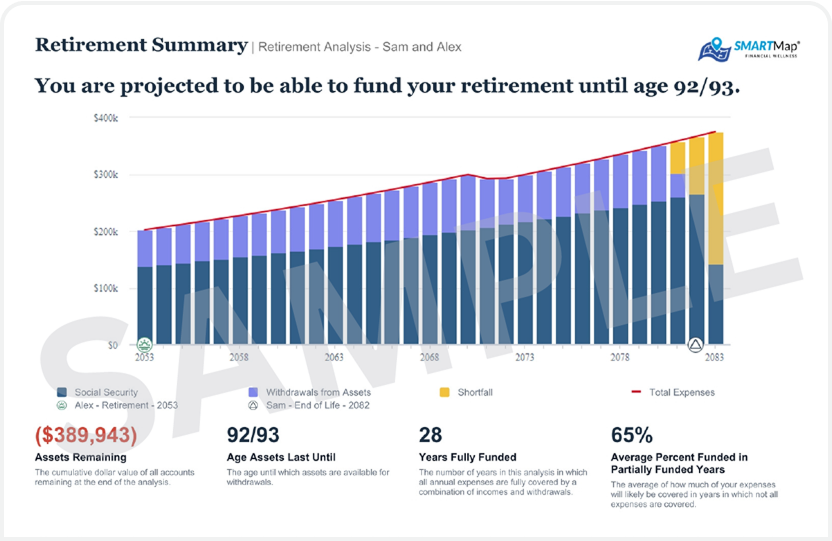

Estimate how much you'll need for retirement, determine appropriate investment strategies, and create a plan to help you achieve your goal.

Map out a savings plan for major purchases, like a home, car, or vacation, and see how it fits within your overall budget.

See how changing your retirement contributions or choosing between pre-tax and Roth can impact your take-home pay.

We also offer additional goal-based reports to support a wide range of needs, including budgeting, investment strategies, college planning, paycheck analysis, and more. These reports can be used on their own or in combination with tools like the SMARTMap Portal to help you visualize your progress and collaborate with your Financial Advocate.

Start Your Journey Today

Your Financial Advocate is here to help you achieve your financial goals, no matter how big or small.