After dropping the benchmark federal funds rate to a range of 0%–0.25% early in the pandemic, the Fe...

Dec 27, 2024

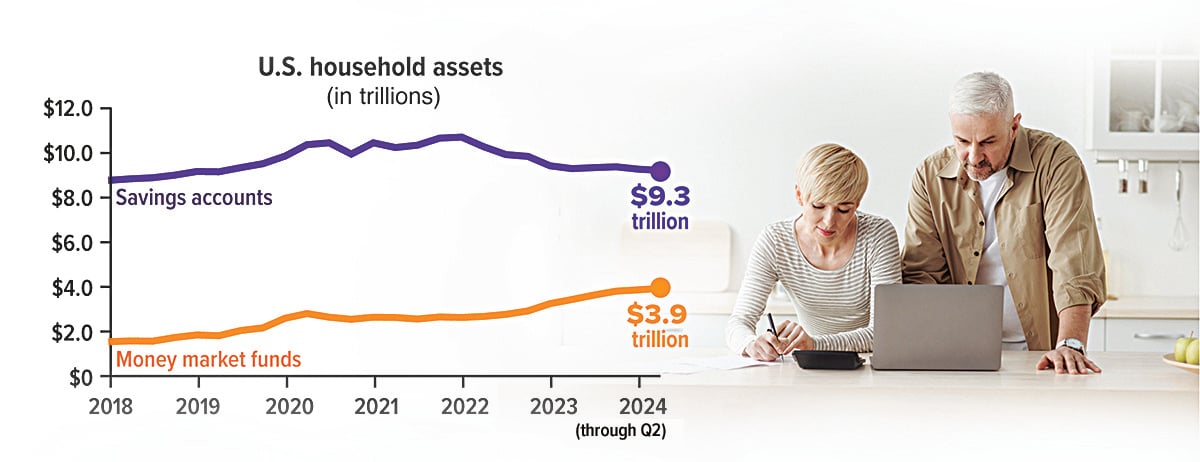

Where Americans Are Stashing Their Cash

The level of the federal funds rate affects many short-term interest rates, including the yield on money market funds, which invest in high-quality, short-term debt instruments and cash equivalents. Investors often use money market funds as "sweep accounts" for clearing brokerage transactions. They can also be a good place to keep cash set aside for emergencies or large purchases such as a vacation, car, or home — especially now that they tend to offer higher yields than most savings accounts.

Source: Federal Reserve, 2024; Money market funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in such a fund. Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Source: Federal Reserve, 2024; Money market funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in such a fund. Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Prepared by Broadridge Advisor Solutions Copyright 2024.

You may also like

Apr 3, 2022

As the Federal Reserve prepares to raise the federal funds rate, it's important to remember that ris...

Sep 18, 2025

Written By: Nate Garrison, CIO, World Investment Advisors What Happened at the Fed's September 2025 ...